What if we told you that hospitals, the most uninteresting-sounding stocks, are actually quite profitable?

In a world where tech dazzles and startups burn capital, India’s hospital chains are doing something extraordinary: Compounding cash flows, expanding margins, and scaling steadily across a country with a billion health concerns—and opportunities. With rising life expectancy, soaring insurance coverage, and medical tourism booming, this is no longer just a sector for social good—it’s one of the strongest long-term investment stories in India.

Welcome to the quiet revolution happening in operating theaters and ICUs. Let’s dive deep into the numbers and unearth the future multibaggers in the Indian healthcare sector! The Indian hospital sector is entering a golden phase. From a historically under-penetrated, low-margin, and infrastructure-heavy sector, hospitals are now morphing into high-return, high-growth platforms driven by structural tailwinds.

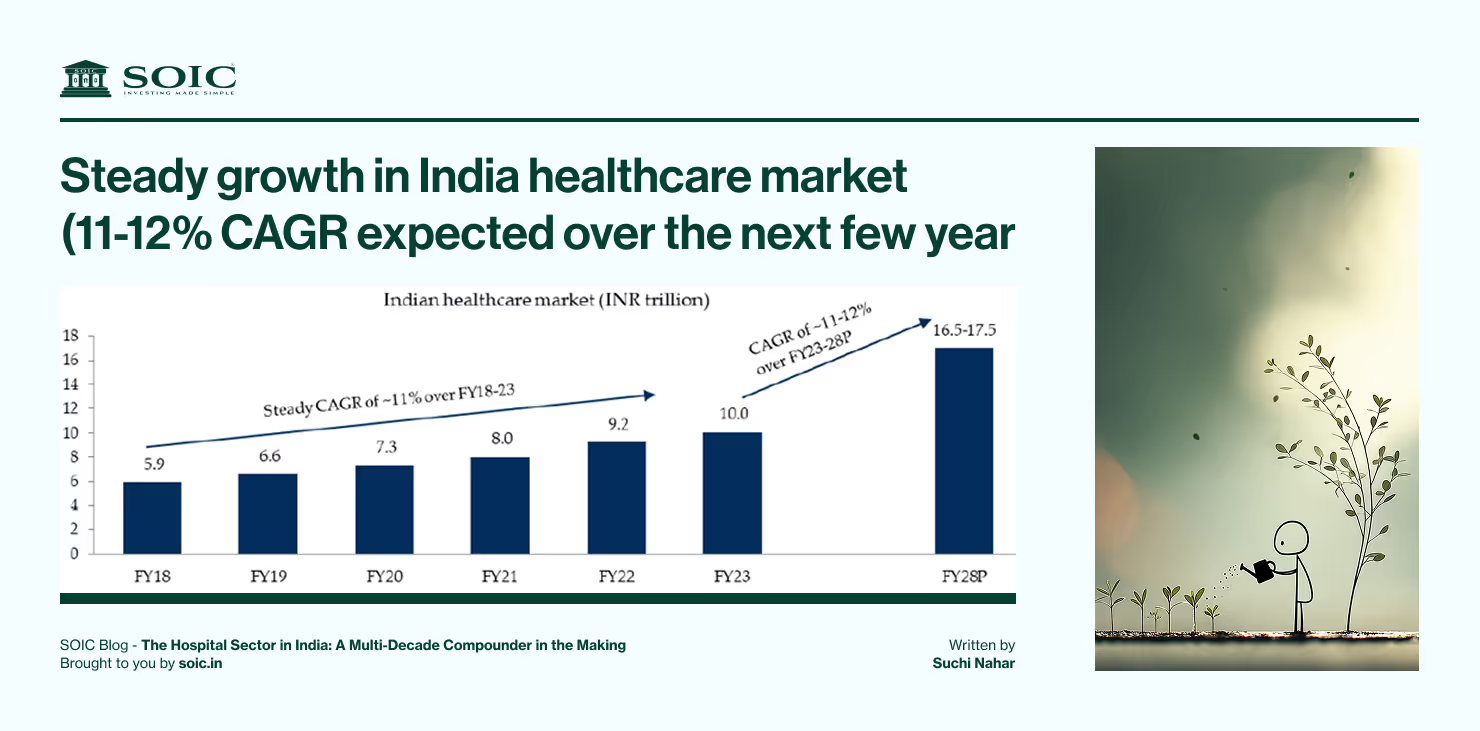

With healthcare delivery forming ~71% of the overall healthcare market and the value of this segment set to cross ₹7.7 trillion by FY27, this is one of the biggest long-term opportunities in Indian equities.

Lease contracts:

In hospitals, the ownership model has become costly because of the steep rise in prices of land, especially in metros/tier-2 cities. This has compelled private companies to look at alternative models where the land-owner develops the building per a private company’s specifications resulting in the latter entering a long-term lease with the former. This also ensures curbing upfront capital deployment, allowing faster expansion.

O&M contracts:

A hospital chain contracts to manage a standalone hospital and oversee functions such as marketing, operation, finance and administration. In return, the chain receives a fixed annual management fee and a share in revenue and profit from the standalone hospital’s owners.

Capital committed by the operator is typically very low, but the brand is diluted if the hospital is not managed efficiently by the operator (the chain)

Medicity (a one-stop centre):

This is an integrated township of super-specialty hospitals, diagnostic centres, medical colleges, research and development, ancillary and supporting facilities. The concept is based on models operating in Scotland, the US, France and Algeria. Similarly, in India, we have Medanta (Gurgaon), Narayana Hrudayalaya (Bengaluru) and Chettinad Health City (Chennai).

The success of a medicity, however, depends on its location and ability to attract patients. Due to large land requirements, health cities are often located on the outskirts of cities, which make attracting patients a challenge unless transportation is available.

Franchisees:

In this model, franchisees obtain premises (owned or leased) and infuse capital (fixed and working), while the franchisor lends its brand name to the healthcare facility for a fee. The franchisor ensures that service quality is maintained across all healthcare centres that use its brand name. It may also help the franchisee in training/ recruiting staff, procuring equipment, designing the facility, etc. In India, Apollo Hospitals has expanded its network of primary clinics through this model.

Expansion into tier-3/-4 towns through primary and secondary hospitals:

Private companies are now making a foray into tier-3/-4 towns as income levels are catching up with those in metros/ tier-2 cities. These regions hold a large share of un-met healthcare demand. Some of the major hospital chains are also expanding into these regions at various price formats, keeping the provision of higher super-specialty services in metros/ tier-2 locations

These are the hospitals we have discussed in our webinars and videos.

Link to our sessions and previous articles:

Hospital Sector Webinar: https://learn.soic.in/learn/hospital-sectoral-analysis

Oct 22, Temperature Check – Hospital Sector Newsletter: https://drive.google.com/file/d/13pkiSjhRzf2J5KmY3wGdFgdAIgQE5DU1/view?usp=sharing

Today, however, we want to highlight a lesser-known name that hasn’t received much attention: Kovai Medical Center & Hospital (KMCH). Let's take a closer look:

Kovai Medical Center and Hospital (KMCH) is a leading multi-specialty healthcare provider based in Coimbatore, Tamil Nadu. Established in 1985, KMCH has grown into a 2,200+ bed facility with a strong presence in tertiary care, medical education, and satellite centers across Tamil Nadu.

The company also has its satellite centers at Ramnagar, Coimbatore (51 beds), Erode (103 beds), Sulur (111 beds), and Kovilpalayam (193 beds), including beds for ICUs, dialysis wards, etc. KMCH has also commenced a medical college with about 150 students intake each year with a 750-bed medical college hospital in the year 2019.

The main hospital at Coimbatore continued to be the major contributor to KMCH’s revenues, with 70-75% of total revenue coming from this center. During the second wave of COVID-19, KMCH had enhanced its medical infrastructure by commissioning a 300-bed hospital in the Medical College Hospital.

The Hospital has been certified by the National Accreditation Board for Hospitals and Healthcare Providers (NABH) for the delivery of high standards for safety and quality care to patients.

KMCH also focuses on quality education and training. The medical college has good equipment like multi-slice CT scanner, MRI scanner, Cath lab equipment and good pathology services. In addition, the operation theatres have got equipment for not just complex surgeries but also for complex minimally invasive surgeries. The Medical College hospital has performed liver and pancreas surgeries and advanced orthopedic surgeries like Arthroscopy and joint replacement.

Kovai Medical Center and Hospital (KMCH) is one of the few hospitals in India that has invested and efficiently leveraged cutting-edge technology to facilitate best-in-class healthcare delivery.

Kovai Medical Center and Hospital inaugurated a new treatment option for cancer. The treatment involves taking a needle under ultrasound or CT scan guidance into the centre of the tumour and destroying the tumour cells by freezing it with liquid nitrogen in a closed loop system. An Israeli company, IceCure Medical, has developed the ProSense Cryoablation System.

IceCure has treated cancer in the kidney, lungs, and liver, and several other types of cancer. ProSense has several advantages, it is minimally invasive with optimal cosmetic outcomes, enables breast cancer patients and non-cancerous tumours to be treated relatively painlessly and is proven to have benefits not only for breast cancer but for lung, liver, renal and bone cancers. IceCure is the third system in India and the first in South India to be installed.

KMCH Main Center has 24 operation theatres and several modern equipment including the Robotic Surgical System of the “da Vinci Si”, Varian Trilogy Linear Accelerator, the world’s most advanced PET CT scan, 3rd Generation Dual Source CT Scanner (latest in technology), Endo Bronchial Ultrasound (EBUS), Extra Corporeal Membrane Oxygenation (ECMO) Machines, 4D ultrasound scanner, Bi plane Cath lab, Cardiac Electro Physiology Lab, Bone Mineral Densitometer, Digital Mammography, Various Laser Equipment, Ultramodern Video endoscope operating neuro microscope, Computer assisted navigation for Hip & Knee replacements, ESWL for the removal of urinary stones.

KMCH continues to be a leader in transplant surgeries which include lungs, kidney, liver, pancreas, bone marrow and cardiac transplants – vindicating the effectiveness of an extraordinarily curated and executed transplant program. Moreover, KMCH commenced the Center for Advanced Lung Diseases and Transplantation with the induction of senior pulmonologists.

KMCH opened a free Paediatric Oncology Ward in KMCH Medical College General Hospital, to cater to the needs of children with cancer, who cannot afford appropriate therapy. KMCH Medical College General Hospital provides outpatient and inpatient services in all specialties, including General Medicine, Paediatrics, Psychiatry, Dermatology, TB and Respiratory Diseases, General surgery, Orthopaedics, ENT, Ophthalmology, Obstetrics & Gynaecology and Dentistry.

A. Revenue Streams

KMCH operates on a hub-and-spoke model, with revenue derived from:

1. Hospital Services (90% of Revenue)

2. Medical Education (10% of Revenue)

KMCH Medical College: 750-bed hospital + 150 MBBS seats/year (₹14 lakh annual fees). Revenue surged to ₹67.1 Cr in FY23 (141% YoY).

3. Ancillary Services

Diagnostics, pharmacy, and telemedicine (growing at ~20% YoY).

B. Key Facilities & Expansion

C. Competitive Advantages

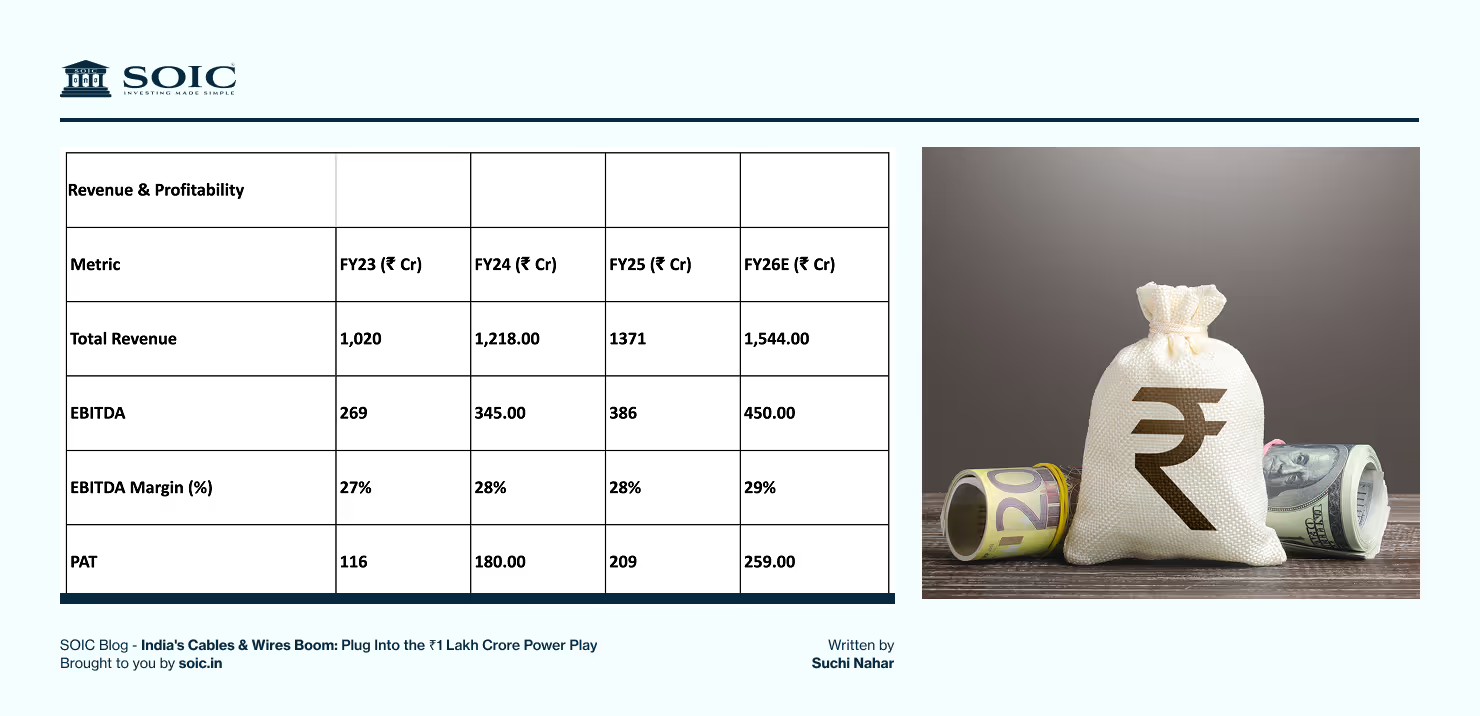

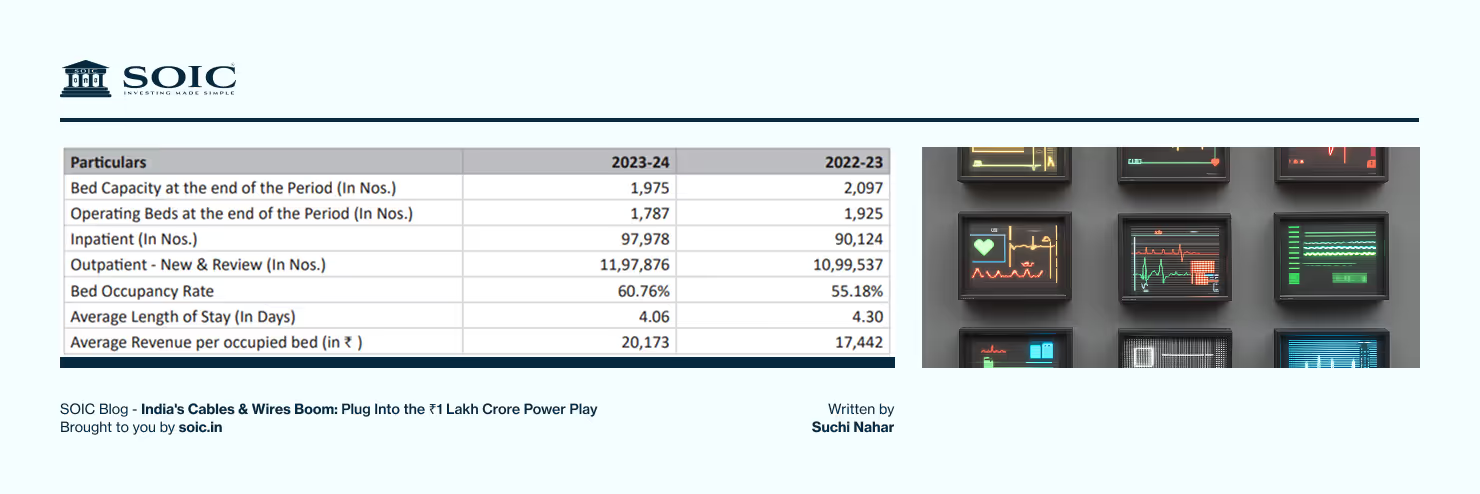

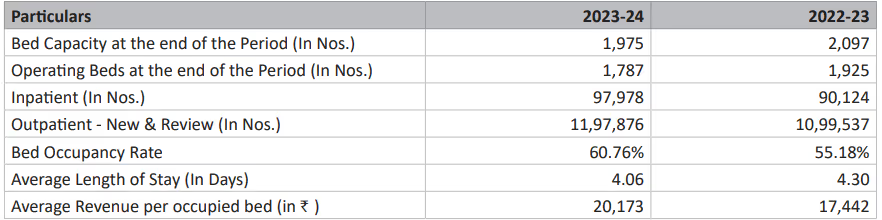

Total Operating Revenue grew by 19.59% from ₹1,019.75 crore in FY23 to ₹1,219.55 crore in FY24. Inpatient revenues rose 18.55% YoY to ₹801.61 crore, and outpatient revenue jumped 17.34% YoY to ₹322.99 crore—both driven by higher surgery volumes and patient footfall. Education services, in their fifth year of reporting, grew 39.5% to ₹93.66 crore, supported by rising enrollments and medical training programs.

A. Revenue & Profitability

Key Drivers:

B. Balance Sheet Strength

A. Expansion Plans

1. Bed Capacity Growth: Target 2,500 beds by FY26 (vs. 1,925 in FY23).

2. Tier-2 Cities: New centers in Trichy, Madurai via asset-light models.

3. Medical Tourism: Focus on Middle East/African patients (cost advantage: 1/5th of Western treatments).

B. Technology & Innovation

C. Education Segment Upside

A. Key Risks

1. Geographic Concentration: 70% revenue from Coimbatore.

2. Doctor Attrition: High reliance on senior specialists.

3. Regulatory Pressures: Price caps on procedures (e.g., NPPA).

B. Mitigation Strategies

Long-Term Growth Drivers

Kovai Medical Center & Hospital (KMCH)

Dr. Arun N Palaniswami has 17 years of experience. He was practicing medicine in the US for 9 years. Dr. Arun worked in hospital administration as director of quality control in KMCH for the last 8 years.

Dr. Nalla G Palaniswami is Managing Director of KMCH. He has over 54 years of experience. Dr. Nalla holds qualifications as MBBS, MD AB (USA).

Dr. Thavamani Devi Palaniswami is Joint Managing Director of KMCH. She has over 46 years of experience. Dr. Thavamani holds qualifications as MBBS, AB (USA).

1. CEA Price Cap Risk: Capping treatment rates at CGHS levels could hit profitability.

2. Human Resources: Skilled doctor/nurse shortages in Tier-2/3 cities.

3. Execution in Greenfield Projects: Slower break-even and higher brand investments.

4. Digital Disruption: Online peers (1mg, Tata, etc.) pushing price wars in diagnostics and OPD.

KMCH may not have the spotlight, but it shines where it matters—with one of the best operating matrices, advanced medical capabilities, and a replicable hub-and-spoke model.

India's hospital sector is emerging as one of the most exciting structural stories in healthcare. It offers:

India's hospital sector isn't just healing patients—it's compounding wealth. With a dynamic shift from infrastructure-heavy expansion to profitable execution, this space is transforming into one of the most powerful multi-decade investment stories in the country.

Every hospital chain, whether scaling metros or conquering Tier-2 cities, is positioning itself to capture a growing wave of demand that's structural, not cyclical.

Whether you're betting on digital disruptors like Apollo, high-efficiency operators like KIMS, or hidden gems like Kovai Medical, the prescription is clear: this is a sector where life-saving and wealth-building go hand-in-hand.

The Indian hospital story has just begun—and for those with patience, precision, and foresight, the prognosis couldn't be more promising. For investors like us, this is a decade-long runway where execution quality, regional dominance, and capital discipline will separate the winners from the rest.

The information provided in this reference is for educational purposes only and should not be considered investment advice or a recommendation. As an educational organization, our objective is to provide general knowledge and understanding of investment concepts. We are SEBI-registered research analysts.

It is recommended that you conduct your own research and analysis before making any investment decisions. We believe that investment decisions should be based on personal conviction and not borrowed from external sources. Therefore, we do not assume any liability or responsibility for any investment decisions made based on the information provided in this reference.

0 Comments